Each year in the United States, approximately 15 percent of all cases of identity theft are cases of new account origination identity theft, according to the Federal Trade Commission. State laws still apply, however, in instances where the cost or other details of the freeze are more favorable than they are under the industry-sponsored alternative.Ĭredit freezes are frequently viewed as the most effective way to prevent financial identity theft. In late 2007, all three of the major credit bureaus (following TransUnion's lead) announced that they would let consumers freeze their credit reports, regardless of the state of residency. The first state to pass a credit freeze law was California, with SB 1386 sponsored by Debra Bowen in 2002, effective 2003. United States Īll 50 states and the District of Columbia have a credit freeze law, the last state to pass such a law being Michigan in 2018. As of February 2021, Ontario was considering changes to its Consumer Reporting Act that would provide for credit freezes. Starting in February 2023, Quebec residents can place a freeze.

The first jurisdiction in Canada to legislatively provide for credit freezes was Quebec, with the passage of Bill 53 (the Credit Assessment Agents Act). Existing companies with access to one's credit profile can still report positive and negative feedback on a credit profile, meaning if the credit profile is frozen, one's credit can still go up or down. Freezing one's credit will not prevent the credit score from changing.

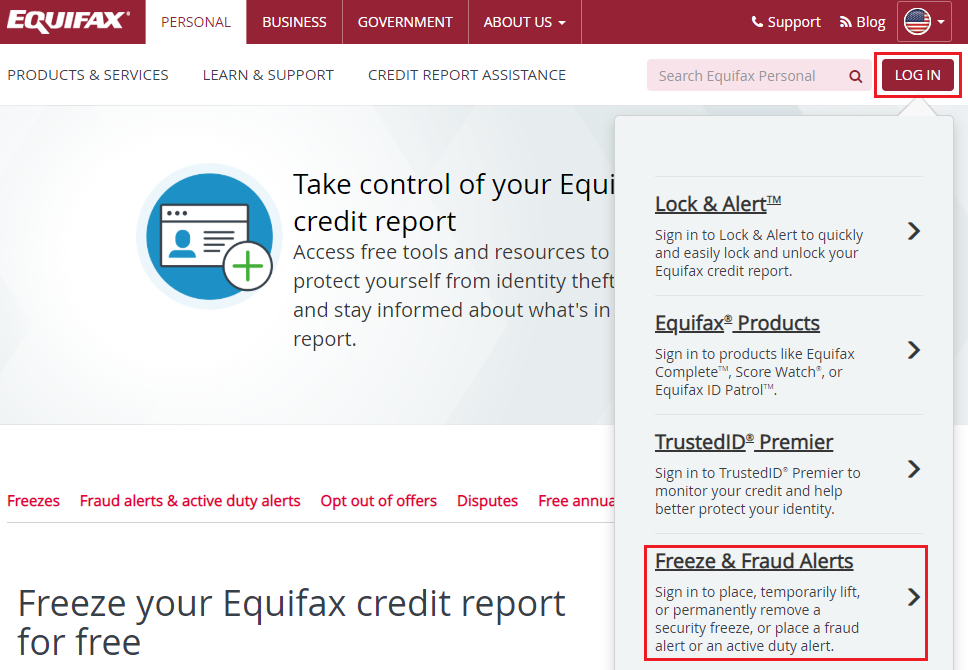

However, in September 2017, a security vulnerability in this system was identified: the PIN is in many cases guessable, and difficult or impossible to reset. In Canada, this has led to TransUnion and Equifax not offering any form of credit freeze (instead directing consumers to their paid identity monitoring services, which have been described as 'ineffective'), until the passage of Quebec's Bill 53, the Credit Assessment Agents Act. Typically, consumer reporting agencies only develop such a feature when prompted to by legislation. The credit freeze locks the data at the consumer reporting agency until the individual gives permission for the release of the data. ( September 2017) ( Learn how and when to remove this template message)Ī credit freeze (also known as a security freeze) allows an individual to control how a consumer reporting agency (also known as a credit bureau: Equifax, Experian, TransUnion, and Innovis) is able to sell personal financial identity data. You may improve this article, discuss the issue on the talk page, or create a new article, as appropriate. The examples and perspective in this article deal primarily with the United States and do not represent a worldwide view of the subject.

0 kommentar(er)

0 kommentar(er)